This post shows you how to go about the KRA PIN Application procedure on iTax. Remember to provide detailed, accurate information when making your application because KRA already has your background information.

A Personal Identification Number (PIN) is used to identify a person or an artificial person ( a Bussiness, company, group etc.), who wish to transact business with Kenya Revenue Authority, Government agencies and other service providers.

Related: How to file KRA tax returns online on iTax

The iTax system is a computing and accounting system for domestic revenues (levies and taxes) which stores data in individual accounts in a database.

The system also assists in monitoring and controlling tax transactions, and is a convenient and more efficient of improving revenue collection, transparency in fiscal administration and management of local tax authorities.

Related: How to change your email address on KRA iTax

KRA PIN Application Process

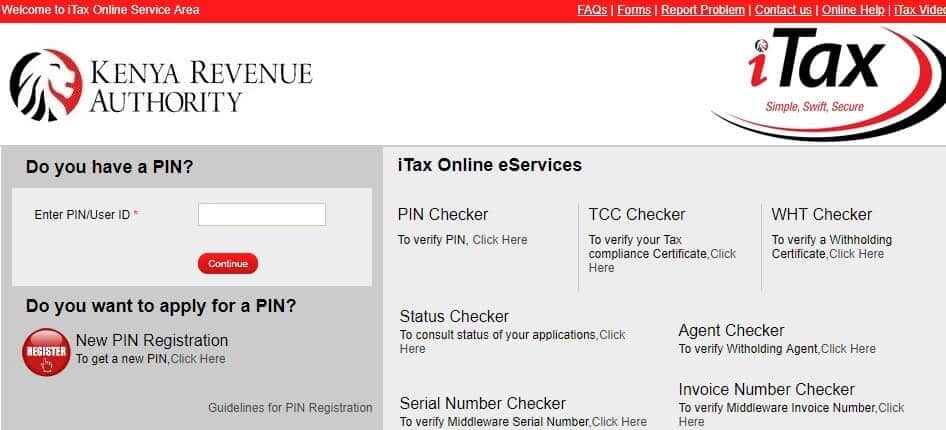

Services Offered on the iTax web Portal.

The following is a list of services offered by the iTax system online.

- PIN Registration and Certificate printing

- Tax Compliance Certificate (TCC) Application

- filing of annual returns

- amending personal details

- applying for refunds

- register payments to make online and pay via Banks

- request for waiver Interest and penalties

- Individuals can access their ledger records for corrections and updating

- apply for Company PIN

Steps for KRA PIN Application procedure on iTax

You can now apply for a KRA PIN certificate by following the KRA PIN application procedure on iTax and be able to submit your tax returns on time. See steps below on how to apply for a new PIN on the iTax Portal for an Individual.

Step 1

Visit the KRA web Portal and Click on the register button as highlighted in the picture below.

Step 2

Under the Individual Registration Form, select the Taxpayer Type as an individual, and the Mode of Registration as the online form then click on the Next Button.

Step 3

Fill in Section A (Basic Information)

At the Citizens field, under Residential details. Select your Citizenship (Kenyan, Non-Kenyan Resident, and Non-Kenyan Non-Resident) and fill in all the fields marked with a red asterisk sign.

Step 4

Section B (Obligation Details)

Once done, filling section A, click the next button to move to the next section. For Kenyan and Non-Kenyan Resident, select the Income Tax Resident field and indicate the registration date, which is the date when you are making the registration. For Non-Kenyan Non-Residents, select the Income Tax Non-Resident Field to provide the date also.

Step Five

Section C (Source Of Income)

Under the sources of the income tab, select the relevant source of income and proceed to fill the forms showed. For students or non-employed select NO in all fields, then click next button.

Final Step (Agent Details)

For individual registrations, one is not required to fill in agents details. Leave it blank, perform the simple arithmetics to show that you are human and Click on the Submit button.

Related: How to file KRA tax returns online on iTax.

Download and print your PIN Certificate together with the acknowledgement receipt.

How to file your KRA Tax Returns Online

- Select the type of return you want to file, Enter your taxpayer’s PIN and select the Tax obligation applicable to you before clicking on ‘Next.’

- Click on the links provided to either download the tax returns form in excel or ODS Format.

- Fill out all the areas shown on the downloaded tax returns form then save your document on your computer. You must enable macros to be able to Validate and zip your file.

- Back at the KRA web page, select the period for which you are filing the returns, then upload your zipped iTax Return form. Agree to terms, then click the submit button. If asked whether to upload a file click ok. That is it; you are now done and can relax.