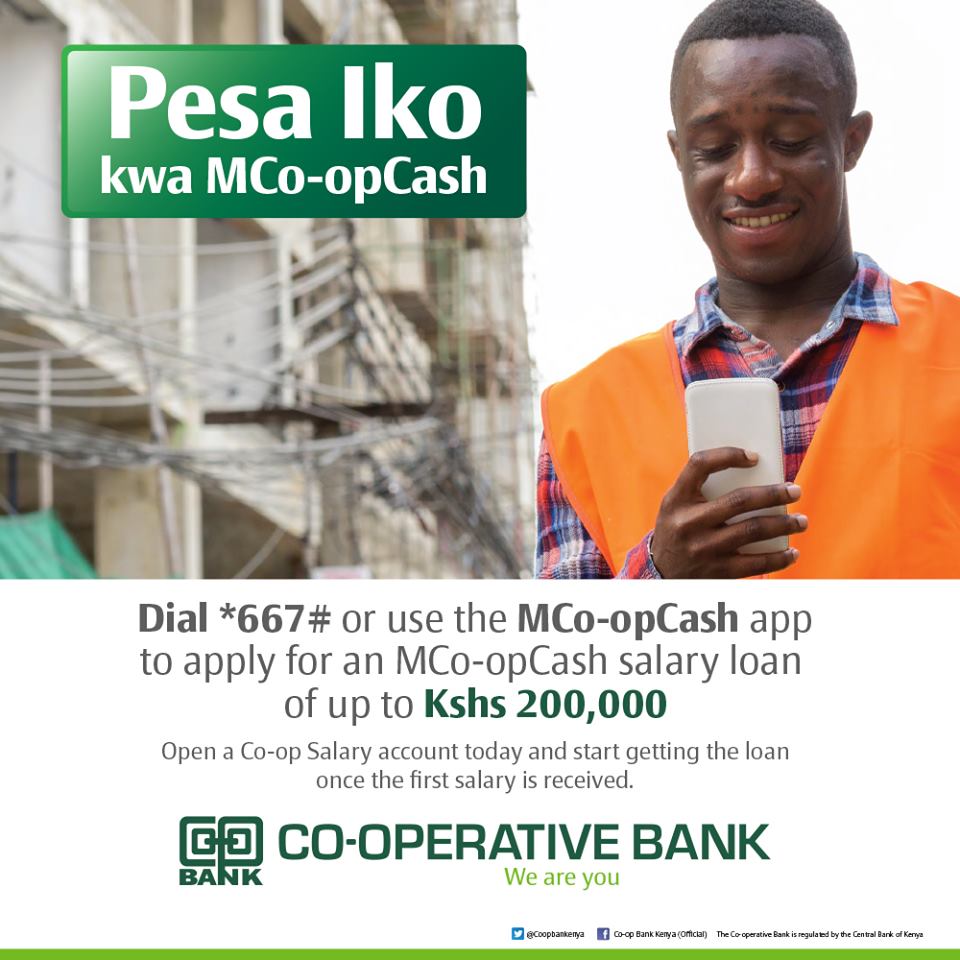

MCo-op Cash is a mobile banking service offered by Co-operative Bank of Kenya. The banking service is available both on app and USSD code. The loan app is also available both on Google’s Playstore and Apple’s App Store.

In this great post, we’re going to show you how;

- MCo-op Cash work?

- How to use the *667# USSD code to access your bank account.

- Types of loans offered by MCo-op Cash

- To download and install the app

- To register on the app.

- How to apply for a loan on the app and believe me, the right way to apply.

- And, lastly, how to contact MCo-op Cash in case you have any problems with your loan.

So, without wasting more time, let’s get you that loan you urgently need.

How does MCo-op Cash work

MCo-op Cash is a mobile banking platform that enables you to do your regular bank transactions the traditional way as if you’re inside the bank itself.

The app or USSD code enables you to deposit and withdraw money from the comfort of anywhere anytime you want.

Apart from depositing and withdrawing, you’re also able to apply and pay for a loan among other things such as paying bills, checking account balance, and transfer of money to other accounts as well as access mobile money services.

Types of loans offered by Mco-op Cash

Co-op Bank provides two types of loans via Mco-op cash; Flexi cash salary advance for salary account holders and Business plus credit for business account holders respectively. So, let’s look at each one of the above loans below.

Related: Co-operative bank of Kenya loans.

Flexi cash salary advance

Co-op bank Flexi loan offers a salary credit of up to 30% of the salary amount on your phone with a loan repayment period of between 1 to 3 months.

The loan is instant as no security or collateral such as three months payslip is required. Equally important, you are required to have a salary account to qualify for this type of loan.

MCo-op Cash business loan

You only need an operational business account for six months to qualify for this type of loan. No stress, no hustles.

How to apply for a loan on Mco-op cash.

- Visit any Co-operative bank branches near you to register for Mco-op cash account and also to link your salary or business account to your mobile number.

- An activation code and OTP PIN will be sent to you via SMS

- Dial *667# or download the Mco-op Cash app.

- Register on the app or USSD code using your National ID or Passport number.

- Log in and to change your PIN.

- You can now apply for a loan by following the system prompts shown.

The loan amount borrowed will be deposited into your account. You can then withdraw the amount instantly to your mobile money wallet, ATM or any of the Co-op Kwa Jirani Agents.

Also read: fixed deposit rates in Kenya

How to contact Co-op Bank

You can contact Co-op bank via any of the following ways

- On Social media through any one of their Twitter handle or Facebook page.

- By directly visiting the customer relationship sections at any one of the Banks branches nearest to you.

That is on Mco-op cash loan, hope you enjoyed reading the post and found it useful. Why don’t you share this post if you love it? Remember sharing is caring. Cheers!