19Today we are particularly interested in Barclays Bank mobile banking. Mobile banking and mobile money transfer have become very popular, especially in Kenya.

The advent of M-Pesa pioneered all this. Ever since preliminary services have been developed around the mobile money giant.

All mobile loan lending apps exist because M-Pesa created a platform for them to thrive. Banks have not been left behind either.

It started with Equity bank launching the Eazzy 247 mobile banking platform, and it became popular. And like I mentioned earlier, I opened my first Equity account via my phone and that was the most natural thing.

The trend later became a norm, and banks like CBA and Barclays among others also joined the rest of the country in mobile banking.

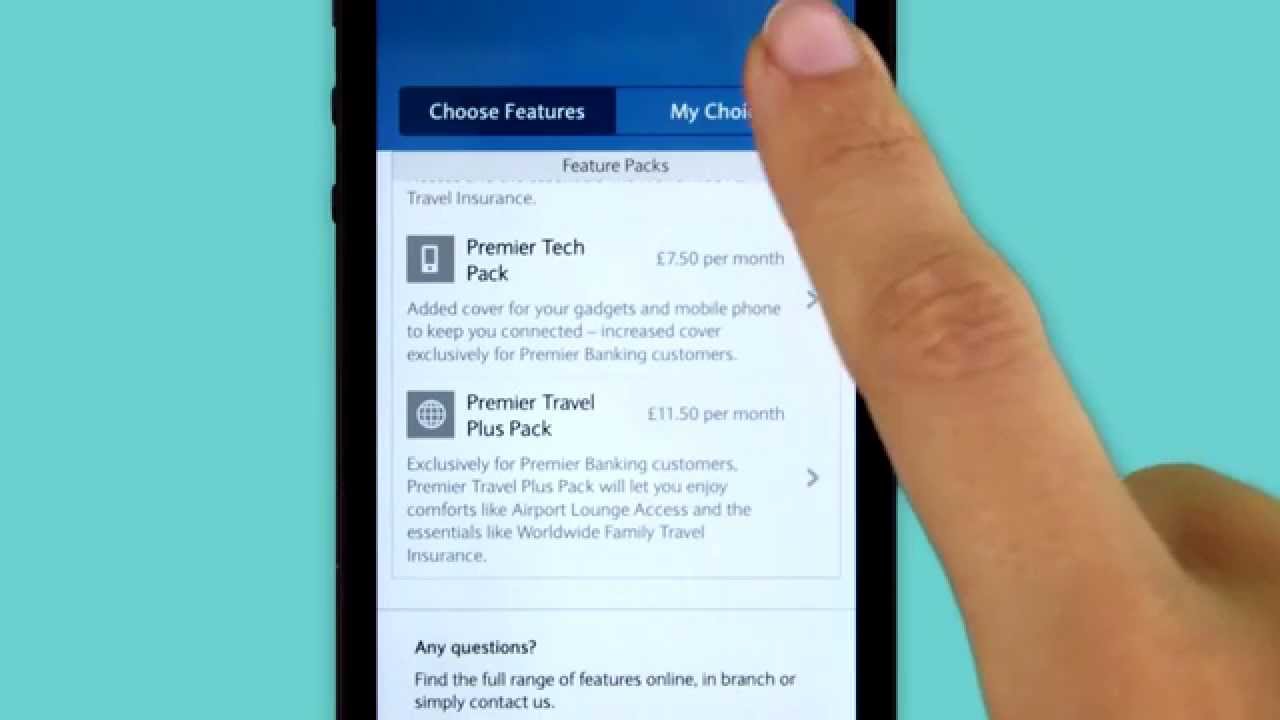

Today, Barclays customers can freely access their money and bank accounts via mobile banking service on *224# or by downloading the Barclays bank mobile App.

With an array of mobile and online banking solutions, Barclay Bank Mobile Banking allows you to the bank faster, more convenient and more conveniently from anywhere, any time. Send cash, pay utility bills, buy airtime all on the go; and have more time for the things you want to.

Barclays Bank mobile banking allows you to:

- Transfer funds

- Check your account balances

- Get mini statements

- Transfer funds to and from M-PESA

- Buy airtime

- Pay your bills

Barclays Bank Mobile Banking Registration

If you have a Debit card then:

- Dial *224# on your phone

- Follow the prompts

If you don’t have a Debit card then:

- Dial *224*224# on your phone

- Follow the prompts

Barclays Bank has adopted mobile technologies that will offer instant credit to micro-entrepreneurs and individual borrowers on a mobile platform, a move aimed at growing its loan book.

The Kenyan market has shifted away from traditional banking transactions to online banking for payment of bills, deposits and money transfers with the increased adoption of smartphones and technology.

A survey of 2,600 banking customers in six African countries released by McKinsey in February showed 53 per cent of customers across the economic segments prefer either the internet or mobile channels, compared to 26 per cent that prefers branch banking.

This has seen the rise of mobile loan applications such as Tala, Branch, Alternative Circle, and Saida. Among the newest entrant is Barclays Bank Timiza app.

The repayment period will be up to 30 days. Barclays Bank said customers would access instant loans of up to Sh150,000. A 6.17 per cent interest rate depending on one’s credit level will be applied on the loans.

The digital platform is also available on USSD code for feature phone users. It is targeting SMEs and retail entrepreneurs.

Safaricom has been profiting from operational flexibility, partnering with most of these firms to facilitate access of loans by customers through M-Pesa and offering customer credit information.

Barclays bank has said the new online banking strategy offers saving opportunity, capital and access to the company’s insurance services to both customers and non-customers, with a critical focus on “young professionals and hustlers in need of growing their business.”

It is this recognition of a continuous need for capital that has motivated Barclays Bank mobile banking to a revolutionary level where both USSD and online mobile banking platforms are available.