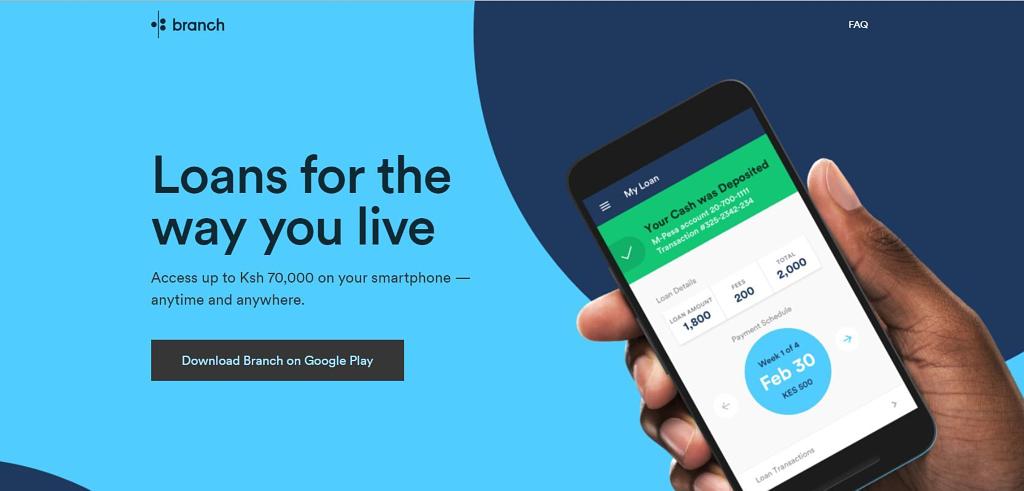

Here is the Branch App Download Guide on how to get a loan on Branch. The Branch loan app is a product of Branch International, a micro-finance mobile lending institution operating in Kenya, Nigeria, Mexico, and India.

Branch International uses the app to make it easy for Kenyan citizens to access emergency loans anytime and anywhere.

If you just landed here, probably you’re looking for a loan. Therefore, kindly read the post below to find out how you can improve your chances of getting credit fast with Branch.

Most Kenyans survive on loans throughout the year. Thanks to mobile phones, there are online platforms such as Branch to get credit straight to your M-Pesa enabled smartphone.

So here is a guide on what is Branch and how to go about the branch app download process.

What is Branch App?

Branch loans usually take up to 24 hours to process, but due to the law of demand and supply, it takes an average of 3 hours for your credit to be processed. That’s quick ha?

If you’re looking for the best app for personal finance or business, then, you’ve come to the right place. Branch is the second-best lending platform after Tala.

Unlike Tala, which takes time to process, these loans are instant. You do not require you to provide your payslip, title deed or whatever collateral for that matter.

What are the Minimum & Maximum Loan I can get From Branch?

Once you download the application from the Google play store, register successfully and qualified. The loans are usually disbursed immediately through Mpesa with the minimum limit being Ksh 250 which can reach up to a maximum of Ksh 70,000.

Currently, Branch has more than 3 million customers, it has so far disbursed more than 15 million loans issued in Kenya, Nigeria, Tanzania, Mexico, and India.

Once you get your loan, choose the repayment period of between 1 to 12 months charged at an adjustable interest rate. Branch interest rate is usually dependent upon a customer’s credit score and Moreover, rates vary by country.

Why Branch Loan App?

1. Their loan products are designed to fit your needs.

2. The loans do not have late penalties or rollover fees.

3. A customer does not need a savings account to access the loan services.

4. Good credit history with them qualifies you for more massive loans with flexible terms.

Must Read: Tala App

How Does Branch App Work?

The mobile application uses machine learning algorithms that process thousands of data entries to assess your credit profile and create tailored loan products. This process helps the application to determine limits available to you.

Data collection is by your permission by accessing the information on your phone such as; SMS logs, Mpesa Logs, Handset Details, GPS Data

Call logs, Social Network Data, Contact lists, etc.

Note: To increase your credit limit, follow the instructions written in the previous post on how to raise your loan limit. I have applied those rules several times on different lending apps, all of which have worked for me 100%. You too can try.

How do you download Branch?

Branch Loan app download only requires your active Facebook account details, mobile number, and a National ID card number after which it scans your phone for the data described above to determine your credit score.

More specifically, you need the following to download branch application:

1. Smartphone – Either Android or iPhone

2. A valid/active Facebook Account.

3. Safaricom line and Tigo Pesa or Vodacom Mpesa if you are in Tanzania

4. Your National ID Number

As stated later in this post, after you’ve downloaded & installed the Application. It will check the information provided by CRB Kenya. This process is done to know your credit score.

How do I Get a Loan from a Branch?

Here is how to apply for a branch loan:

1. Visit Google Play store on an Android smartphone then search for Branch.

2. Download and install it on your phone

3. Go to the app then log in using your official Facebook account or phone number (recommended). (Branch only allows one account per person and the Facebook account you use when you first log into the app is the one we always associate with your account).

4. Open the Application then Click on the left menu. Under Promotions use this code EGR440 to enhance your chance for a higher loan limit and hence getting a loan.

5. Fill out the form provided and submit it for a quick review for your loan.

6. Wait for about an hour or two to apply for your loan.

How do you Withdraw your Loan to Mpesa?

After you fill the form, your loan is automatically disbursed to your M-Pesa Line. They have also partnered with Visa to enable you to withdraw funds from an ATM using “virtual” Visa credentials within that code, no physical debit card or bank account required

How do I Pay my Branch Loan?

1. Navigate to the Mpesa menu on your phone

2. Select the Lipa Na M-Pesa option

3. Use the Pay Bill item and enter this Number 998608

4. Use your mobile number as the Account No.

5. Choose the amount you need to pay.

Always note that you can pay your loan in instalments. After you enter the amount, input your Mobile money PIN and click ok.

You can also check out iPesa loans

Branch Contacts: How do I contact Branch?

Are you in need of help and need branch contacts? Well here is how to contact Branch international in Kenya.

There are many ways to get their contacts and here are four main ways you as a client can use to contact the mobile lender; The first way is through the APP itself where there is a customer care service. You can also use this email address support@branch.co to contact them. They also have an active Facebook page and Twitter accounts.

There you have it those are the currently available contacts.

How to invite friends on social media?

1. Tap on the three bars on the upper left-hand corner of the mobile application

2. Select ‘invite friends’ (your code will show)

3. Tap ‘invite friends’ at the bottom centre

4. Select the messaging or social media to invite friends from.

Your friends will finally receive your invitation message for their action.

Read also: HF Whizz App

How to Earn Commission on Branch Loan App?

Educate your friends about the following points. Your friends should enter your promotion code in the branch app under the ‘promotions’ tab. You will receive a message when your invited friends apply your promotion code. You will receive ksh500 every time a friend repays their first loan.

Please let us hear about your Branch loan experience in the comment section below. Why don’t you share this post?

Before you go, I thought you might also want to read about where to get instant unsecured mobile loans in Kenya. If you have received a loan, you can follow these steps to repay the Branch loan.

this is a brilliant idea.am longing to be part of you.congrants.

I want to regester to branch international

Branch takes too long to upload. Its being uploading for the last six hours. Wondering whether it really works

branch is so naging i dont know how many times they have texted/called me for my petty cash of 250….you are wasting much for less!!!!!!!!nkt

I am totally sad that you have never updated your data base on ID numbers, my number of 0638417 has never been accepted. I tried to apply time and again but the ID fails me. Can someone help me here?

we really appreciate your good job

Branch is nice and helps a lot I love it

I love it its realy helpful

I have had terrible problem registering with Branch. It can’t take my ID No. since it a seven digit one starting with a zero.

I can’t find your app on window phone app store

To assist business.

Wonderful idea! Keep it up

You are saving some awkward situations good job .happy new year 2019.

Thanks guys you help a lot. .. kindly I’ll pay my loan once not in instalment within the payment period msikondee!! Am in branch to stay!!

I thought you have assisted many I would like to be among them thank you!

Why is the app not Available on App Store Iphone ,My loan on branch is over due now , have been trying to make a payment it not just possible , you guys should please do something about this

Comment:The loan will boost my bussiness.

Comment:iget nice service in all website.

Comment:i realy love ur servicess,for its realy give me hope in life.

I have tried to download the app several times and it has resisted.

Comment:Branch you are very slow in offering your services

You have never granted me any despite my trying now and then. What could be the problem? Ps contact me.

You should look for away to help those without smart phones.

good well idear but without smartphone no help why?

give me hope to reach there in my loan 250

Comment:PLEASE GIVE ME THE REAL PICTURE ON HOW TO GET THIS LOAN I AM TIRED OF TRYING MANY TIMES.

Comment: why don’t you make it easy for us to access

Comment:how can I get this loan

Comment:how do I register fot a loan

Comment:l need loon of 2k

Comment:what if my phn is not android?

My phone has issues with downloading now what will i do

I need loan of 3k

Comment:I need a loan of 2K

I need loan 3000

l need loan of 1500

Comment:l need loan of 1500

Comment:Branch boosted up coming young business

Comment:l need an emergency loan of 3000/= and the app is not downloading?

Comment:i need loan of 3000

Comment: for futar of ramadan

Comment: I need 5000,am going to incharnge my mom in the hospital

Comment: when I repay my loan amount this Friday do you increase my loan amount up to 3000 before the you give me….

Comment: I need 1500 to pay for my brother school fees

Comment: I need three thousand to start bessines.

Comment:l need Ksh.1000 to pay my school fees.